It is never too early or too late to start financial planning and saving.

Financial planning assumes great importance in our lives as it helps in accumulating greater wealth as well as helps in gaining financial security.

The key is to make a continuous effort to put away small amounts on a consistent basis. No matter how little you make or how high your expenses may seem, it is nearly always possible to put away at least some money for the future.

While most of us do randomly save and invest in an array of financial instruments, it is always a good idea to do so in a planned and systematic way for best results.

Here are six simple steps to help you plan better and help you towards building a stronger financial future:

1. Define your goals

Goals differ from person to person. All personal wishes and dreams are a goal we strive all our lives to achieve: buying a dream house, giving children a great education, marriages in the family, yearning for an early retirement, long deserved holidays in the Alps, the list goes on.

Each of these goals also has a cost to it; a financial implication and commitment. It is important to define these goals and priortise them first. The next step is to calculate how much money you would need to realise most of them.

Financial professionals often counsel investors to write down their goals. Their intention is not to make you ponder over the meaning of life, but to help you create the best plan to reach those goals along the way.

2. Estimate your present financial position

Having arrived at a ballpark kind of a figure of what is the likely requirement and the time frame for each of the goals it is now important to take stock of your present financial position.

You need to estimate, both, your net worth and your net income/expenses. Your net worth, what accountants call a balance sheet, compares your assets (what you own) with your liabilities (what you owe). It's a snapshot of your financial condition at a specific time.

Your net income/expenses helps you see your monthly disposable income -- i.e., the income you have left over after paying all necessary expenses. And that tells you how much you can afford to contribute to your financial goals each month.

3. Choose your investments according to your life stage

Ability and capacity to take risks varies and the horizon for investments changes depending on the life stage one is in. The type of instrument best suited for an individual depends upon the life stage he or she is in.

If you are between 20 and 40 years of age

People in their twenties and early thirties are in the beginning of their careers. The type of financial planning they do is often influenced by the work sector of their employment.

Many are married and either thinking about having children or already have young ones around the home.

People in their thirties and forties are established in their jobs and in the midst of raising a family. They are concerned about their children's future and, perhaps, equally concerned about elderly parents.

The 20-to-40-year stage is one where responsibilities are relatively less and hence risk-taking capacity is at its highest. Apart from investing in tax-saving instruments, investing a sizeable portion of your invest-able surplus in stocks-either directly or through a mutual fund makes imminent sense.

This is the time to maximise the growth of your investments. You can consider 70-80 per cent exposure in equity and the rest in debt instruments

If you are between 40 and 50 years of age

This is the age when one has to plan for expenses like kids' higher education, their marriage, etc. In this stage, capacity to take risks is lower than in the earlier stage.

Aggressive investing in stocks is not the done thing. In order to balance out the portfolio one should look at some conservative instruments like income funds, bonds and other fixed income instruments.

One may consider reduction in exposure to equities to 40-60 per cent.

If you are between 50 and 60 years of age

Retirement thoughts have now started and the larger expenditures such as child's marriage are lined up. At this stage, preservation of accumulated wealth should be your prime concern; hence growth takes a back seat.

The portfolio requires churning to reallocate risks and a considerable portion of your wealth will need to be parked in lower-risk, fixed income instruments. Liquidity is also a priority at this stage.

A portion of your financial assets should be kept liquid and readily accessible for day-to-day needs and any kind of emergency. A mix of 30-40 per cent in equity and balance in debt and other instruments is recommended.

Retirement

Planning and accumulation for retirement is generally the most important accumulation goal which one addresses in his or her personal financial planning.

Risk management planning and asset allocation into different baskets help in addressing many of the possible risks one encounters on the way to achieving financial goals. However the risk of living too long or outliving your income is the biggest risk during this period.

One has to ensure that all the planning and investing pays-off now and the dividends and/or interest earned on lifelong investments form a steady stream of income sufficient for a decent living.

4. Invest across asset classes to diversify risk

Risk management is the cornerstone of any financial planning effort. One of the basic principles of portfolio building is diversification. As the old saying goes, 'Don't put all your eggs in one basket.'

One can reduce the risk of investing over the long term by spreading out the investments and diversifying into different classes of assets like equities or stocks, bonds and fixed deposits, mutual funds and real estate. Within each category further diversification is also possible. For example, . buying equities or stocks of companies that are involved in different businesses.

5. Decide how active you want to be and implement your plan

Managing one's savings or investments, whether they are in stocks, bonds, mutual funds or real estate requires a good understanding of the markets.

It may be worthwhile to invest some time in learning about these markets and investment options. In the absence of this, one could probably start out by investing in a Systematic Investment Plan of any good mutual fund.

6. Budget for your investments

Once all the planning is done, start investing. The best way is to keep aside a fixed sum of money every month for your investment budget.

This way the expenses remain in control and you will be ensuring that you are moving towards your target. Ideally the amount should reflect your goals and your planning.

It doesn't matter even if it's as small an amount as Rs 1,000 per month. Just start now.

Happy Saving!

The author is Managing Director and CEO, IDBI Capital Market Services Ltd.

Monday, March 26, 2007

Sharepoint portal WSS

I am hearing the word Sharepoint portal very ofter and i know the features of it. Today i got a chance to read the overview of Sharepoit portal service...

Get organized with a SharePoint® Website, the leading Microsoft web solution for document management, team collaboration and information sharing.

Windows SharePoint websites come pre-configured with a host of built-in features and SharePoint templates, providing companies and organizations with a turnkey SharePoint hosting solution that allows staff members to work collaboratively on documents, tasks, lists, calendars, contacts, events, announcements, images, and much more

Top 10 Benefits of Windows SharePoint Services (WSS)

Improve team productivity with easy-to-use collaborative tools Connect people with the information and resources they need. Users can create team workspaces, coordinate calendars, organize documents, and receive important notifications and updates through communication features including announcements and alerts, as well as the new templates for creating blogs and wikis. While mobile, users can take advantage of convenient offline synchronization capabilities.

Easily manage documents and help ensure integrity of content With enhanced document management capabilities including the option to activate required document checkout before editing, the ability to view revisions to documents and restore to previous versions, and the control to set document- and item-level security, Windows SharePoint Services 3.0 can help ensure the integrity of documents stored on team sites.

Get users up to speed quickly User interface improvements in Windows SharePoint Services 3.0 include enhanced views and menus that simplify navigation within and among SharePoint sites. Integration with familiar productivity tools, including programs in the Microsoft Office system, makes it easy for users to get up to speed quickly. For example, users can create workspaces, post and edit documents, and view and update calendars on SharePoint sites, all while working within Microsoft Office system files and programs.

Deploy solutions tailored to your business processes While standard workspaces in Windows SharePoint Services 3.0 are easy to implement, organizations seeking a more customized deployment can get started quickly with application templates for addressing specific business processes or sets of tasks.

Build a collaboration environment quickly and easily Easy to manage and easy to scale, Windows SharePoint Services 3.0 enables IT departments to deploy a collaborative environment with minimal administrative time and effort, from simple, single-server configurations to more robust enterprise configurations. Because deployment settings can be flexibly changed, less pre-planning time is required and companies can get started even faster.

Reduce the complexity of securing business information Windows SharePoint Services 3.0 provides IT with advanced administrative controls for increasing the security of information resources, while decreasing cost and complexity associated with site provisioning, site management, and support. Take advantage of better controls for site life-cycle management, site memberships and permissions, and storage limits.

Provide sophisticated controls for securing company resources IT departments can now set permissions as deep down as the document or item level, and site managers, teams, and other work groups can initiate self-service collaborative workspaces and tasks within these preset parameters. New features enable IT to set top-down policies for better content recovery and users, groups, and team workspace site administration.

Take file sharing to a new level with robust storage capabilities Windows SharePoint Services 3.0 supplies workspaces with document storage and retrieval features, including check-in/check-out functionality, version history, custom metadata, and customizable views. New features in Windows SharePoint Services 3.0 include enhanced recycle bin functionality for easier recovery of content and improved backup and restoration.

Easily scale your collaboration solution to meet business needs Quickly and easily manage and configure Windows SharePoint Services 3.0 using a Web browser or command-line utilities. Manage server farms, servers, and sites using the Microsoft .NET Framework, which enables a variety of custom and third-party administration solution offerings.

Provide a cost-effective foundation for building Web-based applications Windows SharePoint Services 3.0 exposes a common framework for document management and collaboration from which flexible and scalable Web applications and Internet sites, specific to the needs of the organization, can be built. Integration with Microsoft Office SharePoint Server 2007 expands these capabilities further to offer enterprise-wide functionality for records management, search, workflows, portals, personalized sites, and more.

Hosting solution for WSS

Alentus is providing the good WSS hosting

http://www.alentus.com/hosting/spproplan.asp

Source

http://www.alentus.com/hosting/sharepoint.asp

Get organized with a SharePoint® Website, the leading Microsoft web solution for document management, team collaboration and information sharing.

Windows SharePoint websites come pre-configured with a host of built-in features and SharePoint templates, providing companies and organizations with a turnkey SharePoint hosting solution that allows staff members to work collaboratively on documents, tasks, lists, calendars, contacts, events, announcements, images, and much more

Top 10 Benefits of Windows SharePoint Services (WSS)

Improve team productivity with easy-to-use collaborative tools Connect people with the information and resources they need. Users can create team workspaces, coordinate calendars, organize documents, and receive important notifications and updates through communication features including announcements and alerts, as well as the new templates for creating blogs and wikis. While mobile, users can take advantage of convenient offline synchronization capabilities.

Easily manage documents and help ensure integrity of content With enhanced document management capabilities including the option to activate required document checkout before editing, the ability to view revisions to documents and restore to previous versions, and the control to set document- and item-level security, Windows SharePoint Services 3.0 can help ensure the integrity of documents stored on team sites.

Get users up to speed quickly User interface improvements in Windows SharePoint Services 3.0 include enhanced views and menus that simplify navigation within and among SharePoint sites. Integration with familiar productivity tools, including programs in the Microsoft Office system, makes it easy for users to get up to speed quickly. For example, users can create workspaces, post and edit documents, and view and update calendars on SharePoint sites, all while working within Microsoft Office system files and programs.

Deploy solutions tailored to your business processes While standard workspaces in Windows SharePoint Services 3.0 are easy to implement, organizations seeking a more customized deployment can get started quickly with application templates for addressing specific business processes or sets of tasks.

Build a collaboration environment quickly and easily Easy to manage and easy to scale, Windows SharePoint Services 3.0 enables IT departments to deploy a collaborative environment with minimal administrative time and effort, from simple, single-server configurations to more robust enterprise configurations. Because deployment settings can be flexibly changed, less pre-planning time is required and companies can get started even faster.

Reduce the complexity of securing business information Windows SharePoint Services 3.0 provides IT with advanced administrative controls for increasing the security of information resources, while decreasing cost and complexity associated with site provisioning, site management, and support. Take advantage of better controls for site life-cycle management, site memberships and permissions, and storage limits.

Provide sophisticated controls for securing company resources IT departments can now set permissions as deep down as the document or item level, and site managers, teams, and other work groups can initiate self-service collaborative workspaces and tasks within these preset parameters. New features enable IT to set top-down policies for better content recovery and users, groups, and team workspace site administration.

Take file sharing to a new level with robust storage capabilities Windows SharePoint Services 3.0 supplies workspaces with document storage and retrieval features, including check-in/check-out functionality, version history, custom metadata, and customizable views. New features in Windows SharePoint Services 3.0 include enhanced recycle bin functionality for easier recovery of content and improved backup and restoration.

Easily scale your collaboration solution to meet business needs Quickly and easily manage and configure Windows SharePoint Services 3.0 using a Web browser or command-line utilities. Manage server farms, servers, and sites using the Microsoft .NET Framework, which enables a variety of custom and third-party administration solution offerings.

Provide a cost-effective foundation for building Web-based applications Windows SharePoint Services 3.0 exposes a common framework for document management and collaboration from which flexible and scalable Web applications and Internet sites, specific to the needs of the organization, can be built. Integration with Microsoft Office SharePoint Server 2007 expands these capabilities further to offer enterprise-wide functionality for records management, search, workflows, portals, personalized sites, and more.

Hosting solution for WSS

Alentus is providing the good WSS hosting

http://www.alentus.com/hosting/spproplan.asp

Source

http://www.alentus.com/hosting/sharepoint.asp

Thursday, March 22, 2007

Lord and Angel

When God created woman HE was working late on the 6th day

An angel came by and said: “Why spend so much time on that one?”

And the Lord answered:“Have you seen all the specifications I have to meet to shape her ?"

“She must be washable, but not made of plastic, have more than 200 moving parts which all must be replaceable and She must function on all kinds of food, She must be able to embrace several kids at the same time, give a hug that can heal anything from a bruised knee to a broken heart and she must do all this with only two hands”.

The angel was impressed.

“Just two hands....impossible!“

And this is the standard model?!

“Too much work for one day....wait until tomorrow and then complete her“.

“I will not”, said the Lord. “I am so close to complete this creation, which will be the favourite of my heart”.

“She cures herself when sick and She can work 18 hours a day”.

The angel came nearer and touched the woman.

“But you have made her so soft, Lord” “She is soft", said the Lord, “But I have also made her strong. You can’t imagine what She can endure and overcome.“

“Can she think?" the angel asked.

The Lord Lord answered:

“Not only can she think, She can reason and negotiate."

The angel touched the womans cheek....

“Lord, it seems this creation is leaking! You have put too many burdens on her.”

“She is not leaking....it’s a tear” the Lord corrected the angel

“What’s it for?" asked the angel.

And the Lord said:

“Tears are her way of expressing grief, her doubts, her love, her loneliness, her suffering and her pride.”

This made a big impression on the angel; “Lord, you are genius.

You thought of everything. The woman is indeed marvellous!"

Indeed she is!

woman has strengths that amazes man. She can handle trouble and carry heavy burdens.

She holds happiness, love and opinions.

She smiles when feeling like screaming.

She sings when She feels like crying, crys when She is happy and laughs when She is afraid.

She fights for what she belives in.

Stand up against injustice.

She doesn’t take “no” for an answer, when she can see a better solution. She gives herself so her family can thrive. She takes her friend to the doctor if She is afraid.

Her love is unconditional.

She cries when her kids are victorious. She is happy when her friends do well.

She is glad when she hears of a birth or a wedding.

Her heart is broken when a next of kin or friend dies.

But She finds the strength to get on with life.

She knows that a kiss and a hug can heal a broken heart.

There is only one thing wrong with her

She forgets what She is worth...

With Love

Bala

An angel came by and said: “Why spend so much time on that one?”

And the Lord answered:“Have you seen all the specifications I have to meet to shape her ?"

“She must be washable, but not made of plastic, have more than 200 moving parts which all must be replaceable and She must function on all kinds of food, She must be able to embrace several kids at the same time, give a hug that can heal anything from a bruised knee to a broken heart and she must do all this with only two hands”.

The angel was impressed.

“Just two hands....impossible!“

And this is the standard model?!

“Too much work for one day....wait until tomorrow and then complete her“.

“I will not”, said the Lord. “I am so close to complete this creation, which will be the favourite of my heart”.

“She cures herself when sick and She can work 18 hours a day”.

The angel came nearer and touched the woman.

“But you have made her so soft, Lord” “She is soft", said the Lord, “But I have also made her strong. You can’t imagine what She can endure and overcome.“

“Can she think?" the angel asked.

The Lord Lord answered:

“Not only can she think, She can reason and negotiate."

The angel touched the womans cheek....

“Lord, it seems this creation is leaking! You have put too many burdens on her.”

“She is not leaking....it’s a tear” the Lord corrected the angel

“What’s it for?" asked the angel.

And the Lord said:

“Tears are her way of expressing grief, her doubts, her love, her loneliness, her suffering and her pride.”

This made a big impression on the angel; “Lord, you are genius.

You thought of everything. The woman is indeed marvellous!"

Indeed she is!

woman has strengths that amazes man. She can handle trouble and carry heavy burdens.

She holds happiness, love and opinions.

She smiles when feeling like screaming.

She sings when She feels like crying, crys when She is happy and laughs when She is afraid.

She fights for what she belives in.

Stand up against injustice.

She doesn’t take “no” for an answer, when she can see a better solution. She gives herself so her family can thrive. She takes her friend to the doctor if She is afraid.

Her love is unconditional.

She cries when her kids are victorious. She is happy when her friends do well.

She is glad when she hears of a birth or a wedding.

Her heart is broken when a next of kin or friend dies.

But She finds the strength to get on with life.

She knows that a kiss and a hug can heal a broken heart.

There is only one thing wrong with her

She forgets what She is worth...

With Love

Bala

Wednesday, March 21, 2007

Monday, March 19, 2007

My Favorite Duet Songs

Unn Siripinil...

Munbe va en anbe va

tottu tottu

Ragasiamanadu Kadal

Nenjam enum urinile

Malargale malargale

Ponnagai mannan - Enna satham Inda neram

Kadalin deepam ondru

Dhoom2

Dhoom again

Friday, March 16, 2007

Puduvayal - My native place

Wednesday, March 7, 2007

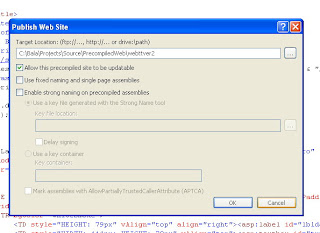

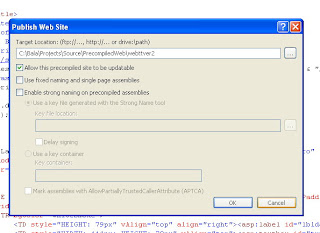

Publish Web site

Yesterday i successfully migrated my application from VS2003 to VS2005 and compiled, and today i tried to publish the web using Build -> Publish web site and i chose the option like below

I published the files in my local hard disk and i created a virtual directory and copied all the files over in the new virtual directory to start the application. I got the error while i expecting my first page of my application.. The error message is

'A name was started with an invalid character. Error processing resource '

The solution is

C:\WINDOWS\Microsoft.NET\Framework\v2.0.50727\aspnet_regiis.exe -i

Installs the version of ASP.NET that is associated with Aspnet_regiis.exe and updates the script maps at the IIS metabase root and below.

Only the script maps for applications that use an earlier version of ASP.NET are updated. Applications that use a later version are not affected.

Cheers

Bala

I published the files in my local hard disk and i created a virtual directory and copied all the files over in the new virtual directory to start the application. I got the error while i expecting my first page of my application.. The error message is

'A name was started with an invalid character. Error processing resource '

The solution is

C:\WINDOWS\Microsoft.NET\Framework\v2.0.50727\aspnet_regiis.exe -i

Installs the version of ASP.NET that is associated with Aspnet_regiis.exe and updates the script maps at the IIS metabase root and below.

Only the script maps for applications that use an earlier version of ASP.NET are updated. Applications that use a later version are not affected.

Cheers

Bala

Tuesday, March 6, 2007

Migrating Web App from ASP.Net 1.x to ASP.Net 2.0

My first ERP type web application is Web based Time Track system and we named it as MPC - Time. What is MPC-Time?

MPC-Time is the ideal time and attendance management solution for any organization. MPC-Time guarantees 100% successful automation for your organization with its high-end built in modules tailor made to meet your organization's needs.

For more informations and demo please visit www.mpctime.com.

Well.. i developed the application with a small team of one Graphic designer and the environment was VS 2003 and later we felt the application need to be migrated to ASP 2.O before adding new features.

Initially i thought its a big task to convert but then i enquired my friends who done the migration works earlier. Also i surfed in Google and i collected the appropriate MS documents to safely migrate and i spent few time to read the complete 20 page document.

finally i used the migration tool which ships with VS 2005 to complete my task and i got hundreds of warning msaages and few error messages and i found there are few bugs made in the converter which messed up few lines of code in the application and i manually fixed it and

MPC-Time is the ideal time and attendance management solution for any organization. MPC-Time guarantees 100% successful automation for your organization with its high-end built in modules tailor made to meet your organization's needs.

For more informations and demo please visit www.mpctime.com.

Well.. i developed the application with a small team of one Graphic designer and the environment was VS 2003 and later we felt the application need to be migrated to ASP 2.O before adding new features.

Initially i thought its a big task to convert but then i enquired my friends who done the migration works earlier. Also i surfed in Google and i collected the appropriate MS documents to safely migrate and i spent few time to read the complete 20 page document.

finally i used the migration tool which ships with VS 2005 to complete my task and i got hundreds of warning msaages and few error messages and i found there are few bugs made in the converter which messed up few lines of code in the application and i manually fixed it and

finally i compiled and ran it.... Its a great.... I appreciated myself and now my app is in 2 flavours one works with Frame work 1.x and another 2.0

Cheers

Bala

Cheers

Bala

My first BLOG

Hi all,

I just wana create a Blog site to enter all my important activities and mile stones which I reached.

I am the one who wish to compare with myself and not with others. I found this way is best to improve the life.

Some times I need a stimulation to tune me, and well my friends are my stimulators and they suggest, guide and stimulate me to go in the right path.

Cheers

Bala

I just wana create a Blog site to enter all my important activities and mile stones which I reached.

I am the one who wish to compare with myself and not with others. I found this way is best to improve the life.

Some times I need a stimulation to tune me, and well my friends are my stimulators and they suggest, guide and stimulate me to go in the right path.

Cheers

Bala

Subscribe to:

Posts (Atom)

Click to Enlarge

Click to Enlarge